A lack of understanding when it comes to loan math is one of the reasons Dave Ramsey is so popular. Too many consumers get underwater and over their heads when they buy a car they really can’t afford. And it’s not just regular, working-class people who have trouble with budgeting, I came across an exotic car lender with loan terms for wealthy buyers who are bad at math.

In all the years I’ve been helping clients buy cars the vast majority of the folks purchasing high-end hardware like Porsches, Ferraris, Astons and such either paid cash or dropped a significant down payment and took a modest loan term. Apparently, there is an entire sub-set of exotic car buyers who are willing to to put themselves in a financially precious situation to drive the car of their dreams. Naturally, there is a loan company for these customers.

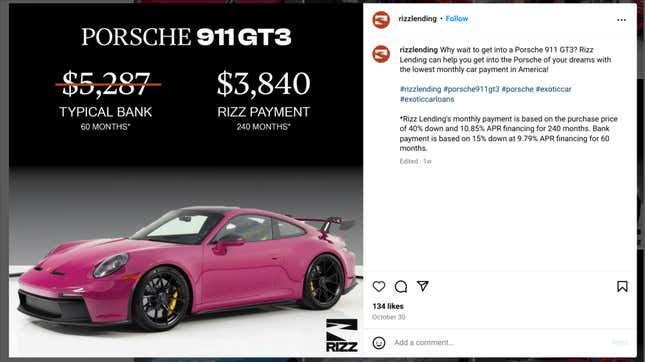

It’s called Rizz Lending. I’m not as up on the slang as I used to be but according to my son who is in 7th grade “rizz” isn’t a thing anymore. I came across this outfit on Instagram where they were advertising a “savings” versus a traditional bank for exotic car loans.

Now the use of the term “savings” is interesting, because the pitch here is that an exotic car buyer will “save” by having lower payments through Rizz Lending versus a traditional car loan. Anyone who knows a little about loan math will tell you that the easiest way to have a lower payment is to stretch the term out. But once you add it all up throughout the loan that “savings” disappears real fast.

Let’s assume for a moment that a buyer could score a brand-new GT3 with a starting MSRP of $222,500 (before destination and additional options) without a markup. RizzLending’s fine print indicates a down payment of 40 percent ($89,000) and monthly payments of $3,840 for 240 months at an APR of 10.85 percent.

If that same buyer were to use a traditional bank using Rizz Lending’s comparison with 15 percent down and loan for 9.97 percent for 60 months with payments at $5,287, that is a total loan cost of $317,220.

After twenty years this buyer will have spent a total of $921,600 in payments, plus their 40 percent down for a grand total of $1,010,600. I may lack an advanced degree in mathematics, but I’m having a hard time conceptualizing how spending an additional $693,380 over the course of twenty years on a sports car is a “savings” versus a normal loan.

Tom McParland is a contributing writer for Jalopnik and runs AutomatchConsulting.com. He takes the hassle out of buying or leasing a car. Got a car buying question? Send it to [email protected]