Hefei, China

On a cold February morning in Hefei, the snow-blanketed grounds of the Chinese Academy of Science’s Institute of Plasma Physics (ASIPP) are unusually quiet. China’s New Year is approaching, and most people in the city are preparing for days of dragon-themed celebrations. But inside the institute, researchers are still hard at work. In a vast control room under a ceiling studded with red neon-lit stars, plasma physicist Xianzu Gong is taming a different kind of fiery beast.

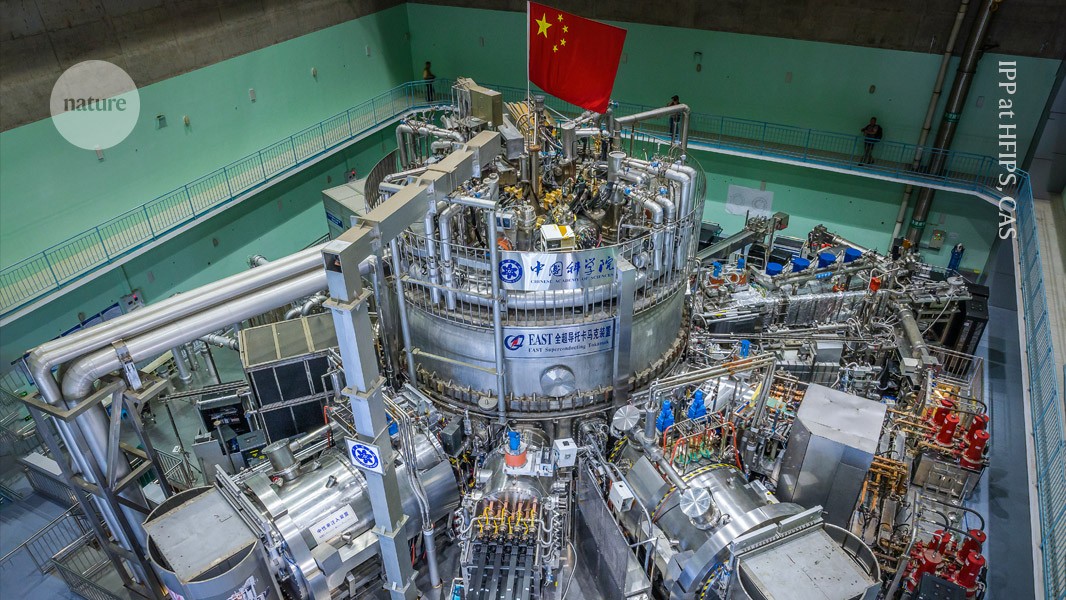

Gong’s dragon is a fusion research reactor: the Experimental Advanced Superconducting Tokamak (EAST). Tokamaks are doughnut-shaped machines that generate the same nuclear reactions that power the stars. They use magnetic fields to confine heated loops of plasma — a fluid-like state of matter containing ions and electrons — at temperatures hotter than the Sun’s core. The aim is to force atomic nuclei to fuse, releasing energy. This could be harnessed as a source of almost limitless clean power, if the scorching, unstable plasma can be maintained and controlled for long enough — a feat yet to be accomplished.

Corralling the unruly plasma is gruelling work. Every day, Gong and his colleagues fire up around 100 shots of plasma from early morning until around midnight. By comparison, the Joint European Torus (JET) in Culham, UK, which was the world’s largest fusion-research facility before it closed last year, achieved 20–30 shots each day. “Almost no weekends, no holidays for us,” says Gong, who heads EAST’s physics and experimental operations.

Xianzu Gong (right), with Yuntao Song, ASIPP’s director-general.Credit: Huang Bohan/IMAGO via Alamy

Although only a stepping stone to anticipated fusion power plants, EAST is one of the facilities that’s putting China on the map in the global race for nuclear fusion.

The world’s most well-known fusion experiment is the US$22-billion International Thermonuclear Experimental Reactor (ITER), a giant tokamak being constructed in southern France, to which China is contributing. And in recent years, ambitious firms in the United States and elsewhere have raised billions of dollars to build their own reactors, which they say will demonstrate practical fusion power before state-led programmes do.

The chase for fusion energy

At the same time, China is fast pouring resources into its fusion efforts. The Chinese government’s current five-year plan makes comprehensive research facilities for crucial fusion projects a major priority for the country’s national science and technology infrastructure. As a rough estimate, China could now be spending $1.5 billion each year on fusion — almost double what the US government allocated this year for this research, says Jean Paul Allain, associate director of the US Department of Energy’s Office of Fusion Energy Sciences in Washington DC. “Even more important than the total value is the speed at which they’re doing it,” says Allain.

“China has built itself up from being a non-player 25 years ago to having world-class capabilities,” says Dennis Whyte, a nuclear scientist at the Massachusetts Institute of Technology (MIT) in Cambridge.

Although no one yet knows whether fusion power plants are possible, Chinese scientists have ambitious timelines. In the 2030s, before ITER will have begun its main experiments, the country aims to build the China Fusion Engineering Test Reactor (CFETR), with the goal of producing up to 1 gigawatt of fusion power. If China’s plans work out, a prototype fusion power plant could follow in the next few decades, according to a 2022 road map (J. Zheng et al. The Innovation 3, 100269; 2022).

“China is taking a strategic approach to invest in and develop its fusion energy programme, with a view of long-term leadership in the global field,” says Yasmin Andrew, a plasma physicist at Imperial College London.

Building artificial suns

Scientists have been trying to make fusion reactors work since the 1950s. The idea is to merge two hydrogen nuclei — which are positively charged and therefore repel each other — into a larger helium one. In the Sun, gravity generates enough pressure to do this; on Earth, high temperatures and strong magnetic fields are necessary. So far, however, researchers haven’t been able to keep fusion reactions running long enough to produce more energy than it takes to spark them.

In late 2022, researchers at the US National Ignition Facility (NIF) in Livermore, California, announced a breakthrough when they briefly recovered more fusion energy than they put into their fuel. Using an alternative design to a tokamak, NIF fired 192 laser beams at a tiny pellet of the hydrogen isotopes deuterium and tritium, causing them to fuse. However, much more energy went into operating the lasers than was delivered to the target. Many researchers say the most practical approach to fusion energy will entail using a tokamak to confine a long-lived ‘burning plasma’, one in which the fusion reactions provide the heat needed to sustain it. One of ITER’s targets, seen as a general prerequisite for viable fusion plants, is to create a burning plasma that produces ten times the power that went into it.

The giant ITER fusion reactor, under construction in France.Credit: Nicolas Tucat/AFP via Getty

If scientists can do this, fusion could offer a safer, cleaner alternative to conventional nuclear-fission power plants that split heavy uranium nuclei, producing radioactive waste that can remain dangerous for thousands of years. Fusion reactors would produce only short-lived waste. Another safety feature is that fusion reactions simply stop if the plasma falls below a certain temperature or density. And the process is expected to be more efficient than fission; the International Atomic Energy Agency says that fusion could generate four times more energy than does fission, per kilogram of fuel.

It’s a particularly tantalizing prospect for China where, between 2020 and 2022, several regions experienced massive power outages owing to skyrocketing demand for electricity during frigid winters. Despite rapid progress in renewable energy, the country still generates more than half of its electricity from coal and remains the biggest contributor to global carbon emissions. And although China is aiming to achieve peak emissions by 2030 and carbon neutrality by 2060, its energy requirements are set to double over the next three decades. “We need innovations that reduce carbon — that’s our dream. Nuclear fusion energy can do this,” says plasma physicist Yuntao Song, ASIPP’s director-general.

China’s vision

In EAST’s control room, Gong prepares to fire another pulse of plasma with a click of his mouse. The plasma itself lies behind the control room’s wall of monitors, confined in a vacuum chamber that has the Chinese flag mounted on its roof. “Every shot could be in support for the future of fusion energy,” Gong says.

China’s involvement in fusion began with building several small and medium-sized tokamaks using components from devices in Russia and Germany. In 2003, it joined the international ITER experiment, alongside the European Union, India, Japan, Korea, Russia and the United States.

US nuclear-fusion lab enters new era: achieving ‘ignition’ over and over

In 2006, China opened EAST, which has since racked up world records for sustaining plasma lasting minutes, instead of seconds. EAST’s knack for creating long-lived plasmas has made it an experimental workhorse for ITER, particularly for quickly cross-checking results, says Alberto Loarte, who heads ITER’s science division. “The research in China is extremely dynamic,” he says.

Loarte cites how, this January, he and his colleagues spent a week running experiments at EAST, to verify that lining a reactor’s plasma-facing walls with tungsten can achieve a tightly confined plasma, even if the walls aren’t also coated with a boron layer to keep out impurities. (These findings will help ITER, at which in October 2023 researchers decided to switch wall-linings to tungsten instead of beryllium.) In many countries, such an effort would have taken months to organize, says Loarte. But in China, plans often come together in weeks because many research groups don’t require formal proposals or lengthy discussions to get to work.

ITER originally aimed to start experiments in 2020 but has been plagued by delays. In July, researchers announced that it will push back its major experiments to 2039. Most ITER countries are developing their domestic fusion capabilities in parallel, but few are doing so as intensively as China, says Jeronimo Garcia Olaya, a fusion scientist at the French Alternative Energies and Atomic Energy Commission in Paris. “They are building a very ambitious programme,” says Olaya, who co-leads experiments at JT-60SA in Naka, Japan, currently the world’s largest tokamak in operation.

Among China’s other research fusion reactors, besides EAST, is its HL-3 tokamak, opened in 2020 at the Southwestern Institute of Physics in Chengdu. Experiments at China’s facilities will feed into the next-generation CFETR, although construction still needs approval from the government. An official at ASIPP who didn’t want to be named couldn’t give a timeline for this, but says that the government is factoring ITER’s timeline into its decision. The CFETR, which will be slightly bigger than ITER, aims to bridge the gap between ITER — a purely experimental device — and demonstration plants that would generate electricity.

A researcher in EAST’s vacuum chamber.Credit: Institute of Plasma Physics at Hefei Institutes of Physical Science, Chinese Academy of Sciences

CFETR first aims to generate between 100 and 200 megawatts of net power: producing more power than went into heating the plasma, but not enough to cover the electricity used to operate the facility. By the 2040s, its goal is to deliver more than ten times as much heat as is directly put into the plasma, the milestone for viable fusion, and also to produce up to a gigawatt of net power. If this could be achieved, demonstration power plants would then produce grid electricity.

ITER delay: what it means for nuclear fusion

CFETR’s engineering design report, released in 2022, places the facility ahead of several demonstration power plants, including the European Union’s and Japan’s proposed DEMO reactors — expected to begin their engineering designs in 2029 and 2025, respectively.

China’s strength in fusion research lies not so much in stand-out engineering innovations, says Allain, as in its speed and focus on developing the materials, components and diagnostics systems needed to build reactors.

To develop CFETR, ASIPP has started building a sprawling 40-hectare workshop (about the size of 60 football fields) a short drive from EAST. Scheduled for completion next year, the Comprehensive Research Facility for Fusion Technology (CRAFT) is a massive hub where researchers will develop and manufacture materials, components and prototypes for CFETR and subsequent fusion power plants.

An aerial shot of China’s Comprehensive Research Facility for Fusion Technology (CRAFT) in Hefei.Credit: Zheng Xianlie/Xinhua via Alamy

In the United States, a similar facility to develop key fusion technologies has been flagged as a priority for years, but plans have failed to materialize owing to limited funding and other issues, says Whyte. “It has been frustrating,” he says. “There are positive signs of change, but we lost our lead.”

China’s focus on building a fusion workforce has also given the country an edge in personnel, says Hongjuan Sun, a plasma physicist at the UK Atomic Energy Authority in Abingdon. “They really put a lot of effort in training the next generation,” says Sun, who worked on JET. Allain estimates that China has thousands of PhD students in fusion, compared with mere hundreds in the United States.

Commercial efforts

Although China’s programme is ramping up fast, start-up firms around the world make much bolder claims about the pace with which they can commercialize fusion energy.

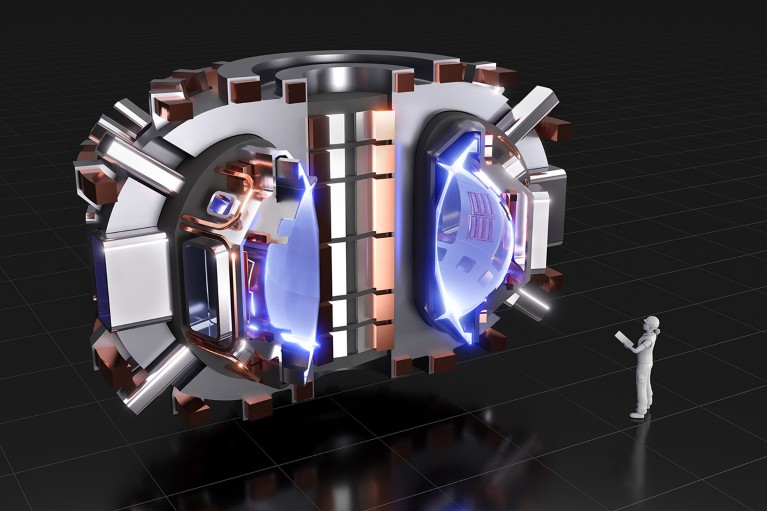

For example, Commonwealth Fusion Systems (CFS), a spin-off from MIT, promises that its tokamak, called SPARC, will be the first to churn out more fusion energy than the heat that the plasma consumes. The firm, which is based in Devens, Massachusetts, and is working with MIT researchers, says SPARC will produce its first plasma by the end of 2026. The effort relies on advances in high-temperature superconducting materials, which should allow the tokamak to be much smaller and quicker to build than ITER and other giant facilities. CFS says it will have plants supplying electricity grids by the early 2030s. Other firms are making similarly bullish statements about various designs for pilot fusion plants.

A design rendering of the compact SPARC tokamak, being built in Devens, Massachusetts.Credit: CFS/MIT-PSFC — CAD Rendering by T. Henderson

Globally, more than 40 companies are working to commercialize fusion, and together have received investments of $7.1 billion, says the US-based Fusion Industry Association (FIA).

But China’s industrial efforts are burgeoning, too. The country’s fusion start-ups have attracted more than $500 million in investment in just a few years, says Andrew Holland, chief executive of the FIA. That places China second only to the United States, which has poured more than $5 billion into fusion companies. “The private fusion effort in China is significant,” he says.

In January, the Chinese government launched a national consortium called China Fusion Energy. Led by the China National Nuclear Corporation, it brings together 25 government-owned companies, four universities and a private firm with the goal of pooling resources to accelerate China’s fusion effort.

Among industrial heavyweights in fusion research is the ENN Group, one of China’s biggest private energy conglomerates. According to the FIA, the company has invested more than $200 million in its fusion energy programme. An ENN road map envisages building a ‘commercial demonstration’ reactor by 2035.

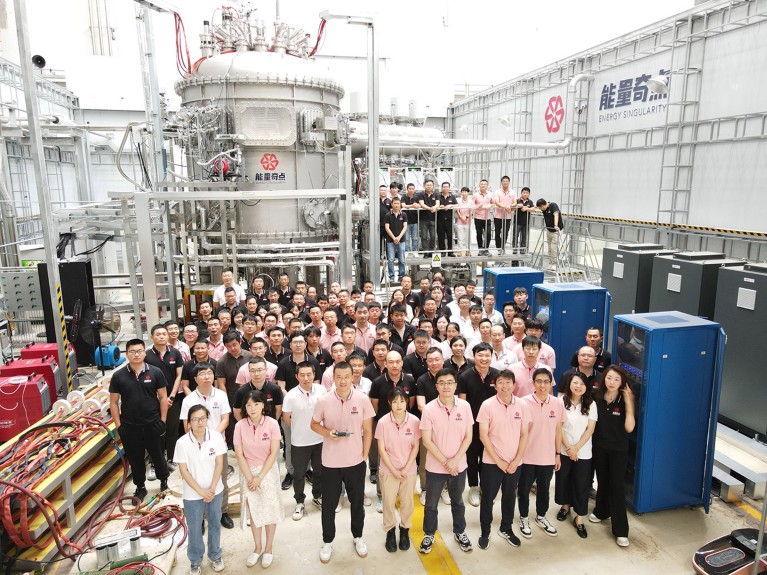

A handful of dedicated fusion companies have sprouted up in China over the past three years. Among them is Energy Singularity, a Shanghai-based start-up founded in 2021 and the country’s first dedicated fusion power firm. Much like SPARC, Energy Singularity aims to build smaller, less expensive tokamaks by taking advantage of the latest materials for magnets; it has so far attracted around $110 million in funding, says co-founder Zhao Yang. In June, the firm’s HH70 tokamak achieved its first plasma and using high-temperature superconducting magnets — a world first, Yang says.

The HH-70 tokamak from Energy Singularity, China’s first dedicated fusion-power company.Credit: Energy Singularity

Energy Singularity is planning a next-generation device, HH170, which aims to produce ten times more energy than the heat needed to fuel the plasma. Just as optimistically as the US firms, Yang estimates that the small tokamak will take only three to four years to build, instead of decades.

One of the big questions in fusion surrounds the availability of fuel. For tokamaks, a mixture of deuterium and tritium (D–T) isotopes is considered one of the most efficient fuels. But tritium occurs in minuscule traces in nature, so will need to be produced in fusion facilities, through a reaction between the neutrons produced during fusion reactions and a blanket of lithium in the tokamak wall. Whether such ‘tritium breeding’ can actually work is unclear.

ITER is one of the largest research efforts that will explore this question. But China has speedier plans: its Burning Plasma Experimental Tokamak (BEST), built next to CRAFT and due to be completed in 2027, will also run D–T experiments and explore whether tritium can be bred, says ASIPP director Song.

It’s all part of a long-term push to develop what many see as a key solution to the world’s energy problems. Back at EAST, in contrast to the bullish claims of private firms, Gong sees the race for fusion energy more as a marathon than a sprint. He has thousands of plasma shots ahead of him. “There’s still a lot of work we need to do,” he says.